NO (1A)

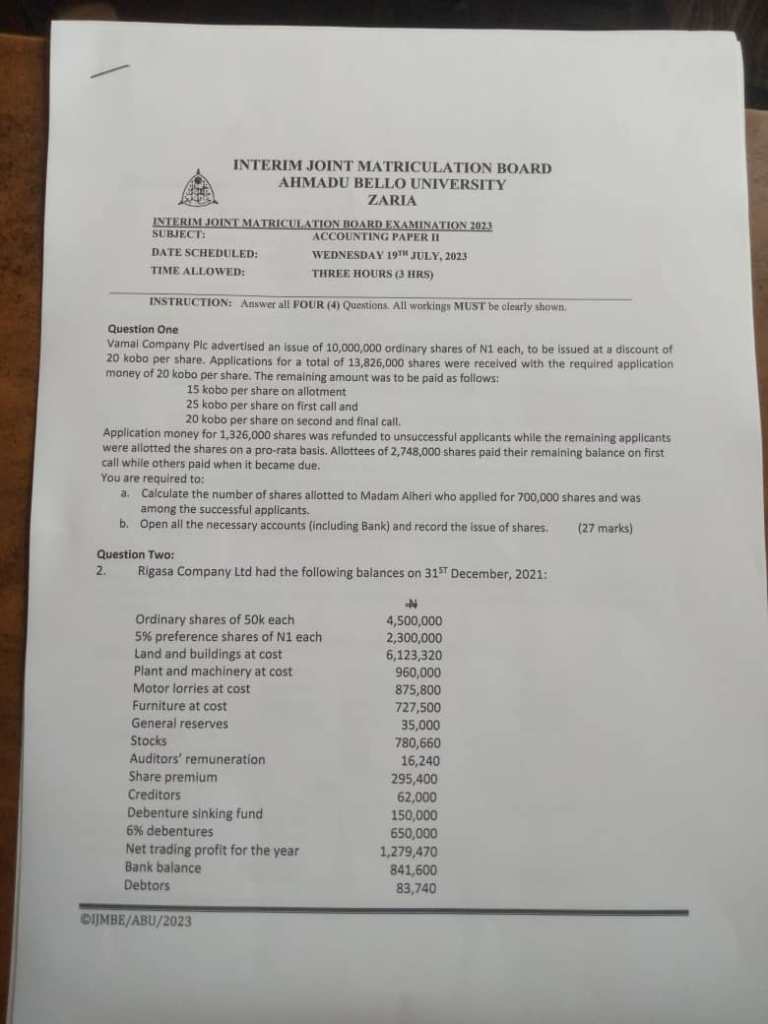

To calculate the number of shares allotted to Madam Alheri who applied for 700,000 shares and was among the successful applicants, we need to use the pro-rata basis formula:

Total shares applied for / Total shares available x Shares allotted

The total shares applied for is 13,826,000 – 1,326,000 = 12,500,000 shares (since 1,326,000 shares were refunded to unsuccessful applicants).

The total shares available is 10,000,000 shares.

Therefore, the shares allotted per share applied for is 10,000,000 / 12,500,000 = 0.8.

Madam Alheri applied for 700,000 shares, so the number of shares allotted to her is:

700,000 x 0.8 = 560,000 shares

Therefore, Madam Alheri was allotted 560,000 shares.

(1b) Here are the necessary accounts to open and record the issue of shares:

(i) Bank Account:

=TABULATE=

Debit:

– Cash received from applicants = 13,826,000 x 0.2 = N2,765,200

– Application Account = N1,326,000 x 0.2 = N265,200

– Bank Account = N9,734,800

Credit:

– Application Account = N2,765,200

– Bank Account = N265,200

– Share Capital Account = N10,000,000 (Nominal value of shares)

(ii) Share Capital Account:

=TABULATE=

Debit:

– Bank Account = N9,734,800

– Bank Account = N2,748,000 x 0.25 = N687,000

Credit:

– Share Capital Account = N9,734,800 (Amount received on first call)

– Share Capital Account = N687,000 (Amount received on second and final call)

(iii) Allotment Account:

=TABULATE=

Debit:

– Application Account = N2,765,200

– Allotment Account = N560,000 x 0.15 = N84,000

Credit:

– Allotment Account = N2,765,200

– Share Capital Account = N84,000 (Amount received on allotment)

(iv) Application Account:

=TABULATE=

Debit:

– Bank Account = N265,200

– Allotment Account = N2,765,200

Credit:

– Application Account = N265,200

NO 2

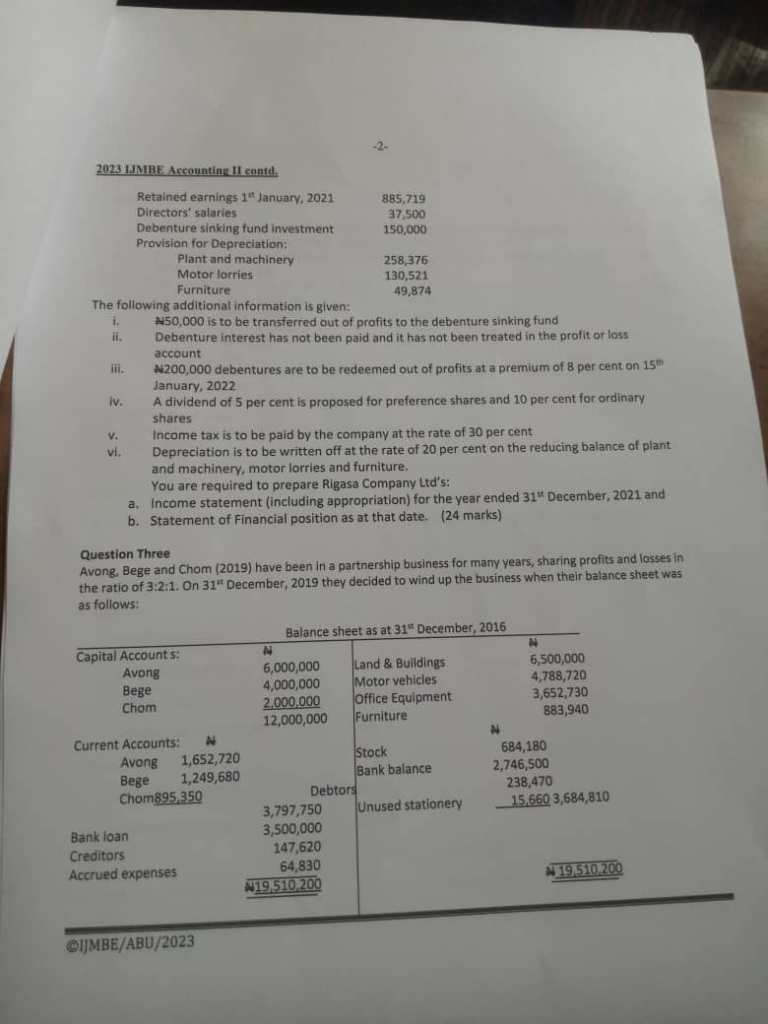

Income Statement (including appropriation) for the year ended 31 December 2021:

Net Trading Profit:

Net Trading Profit = Net trading profit for the year – Auditors’ remuneration

Net Trading Profit = ₦1,279,470 – ₦16,240

Net Trading Profit = ₦1,263,230

Interest on Debentures:

Interest on Debentures = 6% of ₦650,000

Interest on Debentures = 0.06 * ₦650,000

Interest on Debentures = ₦39,000

Income Tax:

Income Tax = 30% of Net Trading Profit

Income Tax = 0.30 * ₦1,263,230

Income Tax = ₦378,969

Net Profit for the Year:

Net Profit for the Year = Net Trading Profit – Interest on Debentures – Income Tax – Transfer to Debenture Sinking Fund

Net Profit for the Year = ₦1,263,230 – ₦39,000 – ₦378,969 – ₦50,000

Net Profit for the Year = ₦795,261

Appropriation:

Dividend for Preference Shares:

Dividend for Preference Shares = 5% of ₦2,300,000

Dividend for Preference Shares = 0.05 * ₦2,300,000

Dividend for Preference Shares = ₦115,000

Dividend for Ordinary Shares:

Dividend for Ordinary Shares = 10% of ₦4,500,000

Dividend for Ordinary Shares = 0.10 * ₦4,500,000

Dividend for Ordinary Shares = ₦450,000

Transfer to Debenture Sinking Fund: ₦50,000

Retained Earnings:

Retained Earnings = Net Profit for the Year – Dividend for Preference Shares – Dividend for Ordinary Shares

Retained Earnings = ₦795,261 – ₦115,000 – ₦450,000

Retained Earnings = ₦230,261

Income Statement (including appropriation) for the year ended 31 December 2021:

Net Trading Profit: ₦1,263,230

Less: Auditors’ remuneration: -₦16,240

Interest on Debentures: -₦39,000

Income Tax: -₦378,969

Transfer to Debenture Sinking Fund: -₦50,000

Net Profit for the Year: ₦795,261

Appropriation:

Dividend for Preference Shares: -₦115,000

Dividend for Ordinary Shares: -₦450,000

Retained Earnings: ₦230,261

(2b)

Statement of Financial Position as at 31 December 2021:

Assets:

Current Assets:

Bank balance: ₦841,600

Debtors: ₦83,740

Stocks: ₦780,660

Total Current Assets: ₦1,705,000

Non-Current Assets:

Land and buildings at cost: ₦6,123,320

Plant and machinery at cost: ₦960,000

Motor lorries at cost: ₦875,800

Furniture at cost: ₦727,500

Less: Provision for Depreciation:

– Plant and machinery: -₦258,376

– Motor lorries: -₦130,521

– Furniture: -₦49,874

Total Non-Current Assets: ₦4,348,849

Total Assets: ₦6,053,849

Liabilities and Equity:

Current Liabilities:

Creditors: ₦62,000

Total Current Liabilities: ₦62,000

Non-Current Liabilities:

6% Debentures: ₦650,000

Debenture sinking fund: ₦150,000

Total Non-Current Liabilities: ₦800,000

Equity:

Ordinary shares: ₦4,500,000

5% Preference shares: ₦2,300,000

Share premium: ₦295,400

General reserves: ₦35,000

Retained earnings: ₦230,261

Total Equity: ₦7,360,661

Total Liabilities and Equity: ₦6,053,849

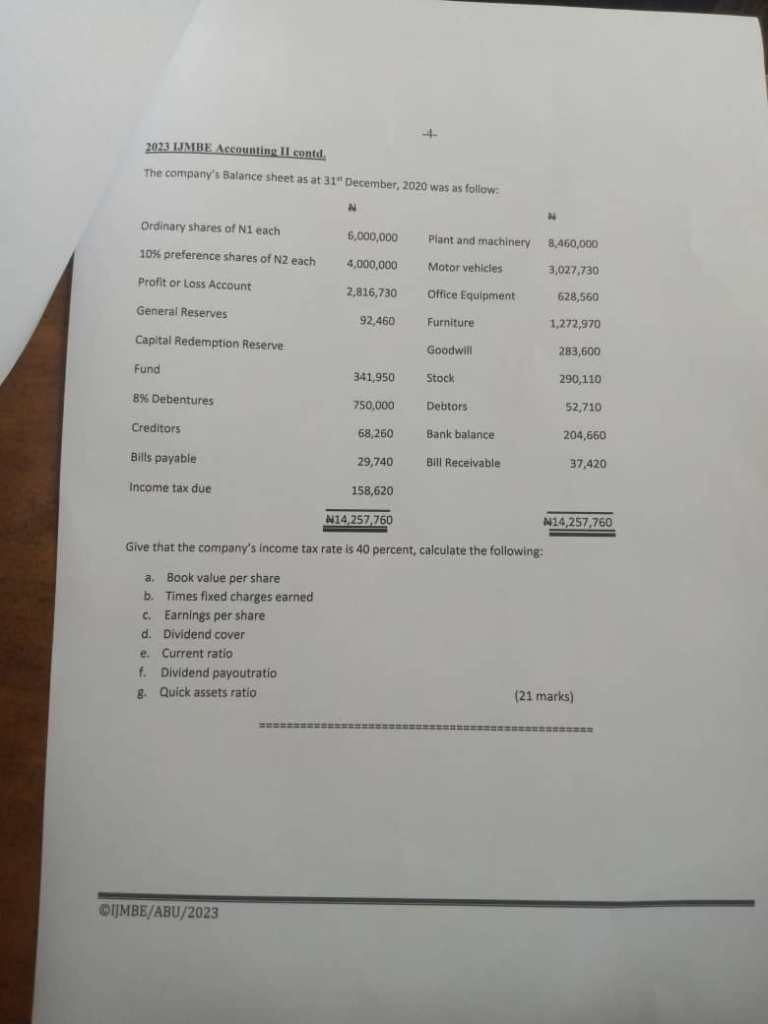

NO 4

a. Book value per share

The total equity of the company as at 31 December 2020 was:

Ordinary shares of N1 each = N6,000,000

10% preference shares of N2 each = N4,000,000

Profit or Loss Account = N2,816,730

General Reserves = N92,460

Capital Redemption Reserve Fund = N0

Total equity = N12,909,190

The number of shares issued is:

Ordinary shares of N1 each = 6,000,000

10% preference shares of N2 each = 2,000,000

Total number of shares = 8,000,000

Book value per share = Total equity / Total number of shares

= N12,909,190 / 8,000,000

= N1.6136

b. Times fixed charges earned

Fixed charges are the total of interest and debenture redemption charges.

Interest on 8% debentures = 8% x N8,460,000 = N676,800

Times fixed charges earned = (Profit before interest and tax + Fixed charges) / Fixed charges

Profit before interest and tax = Profit or Loss Account + Income tax due

= N2,816,730 + (40% x N283,600)

= N2,916,730

Times fixed charges earned = (2,916,730 + 676,800) / 676,800

= 5.31 times

c. Earnings per share

Earnings per share = (Profit after tax – Preference dividends) / Number of ordinary shares

= (N1,816,638 – N400,000) / N6,000,000

= N0.2694

d. Dividend cover

Dividend cover = Profit after tax / Dividend on ordinary shares

= N1,816,638 / N750,000

= 2.42 times

e. Current ratio

Current assets = Stocks + Debtors + Bank balance + Bill Receivable

= N283,600 + N290,110 + N52,710 + N341,950

= N968,370

Current liabilities = Creditors + Bills payable + Income tax due

= N204,660 + N37,420 + N158,620

= N400,700

Current ratio = Current assets / Current liabilities

= N968,370 / N400,700

=2.42 times

e. Current ratio

Current assets = Stocks + Debtors + Bank balance + Bill Receivable

= N283,600 + N290,110 + N52,710 + N341,950

= N968,370

Current liabilities = Creditors + Bills payable + Income tax due

= N204,660 + N37,420 + N158,620

= N400,700

Current ratio = Current assets / Current liabilities

= N968,370 / N400,700

= 2.42 times

f. Acid test ratio

Acid test ratio = (Current assets – Stocks) / Current liabilities

= (N968,370 – N283,600) / N400,700

= 1.91 times

g. Gross profit margin

Gross profit margin = (Gross profit / Sales) x 100

= (N1,226,000 / N3,850,000) x 100

= 31.79%

h. Net profit margin

Net profit margin = (Profit after tax / Sales) x 100

= (N1,816,638 / N3,850,000) x 100

= 47.19%

2023 IJMB ACCOUNTING II QUESTIONS ⤵️

Contact Us Only On WhatsApp : 08167972482

Click Here To Join Our WhatsApp Group